BRANZ: On the rise

By Matthew Curtis, BRANZ Senior Research Analyst

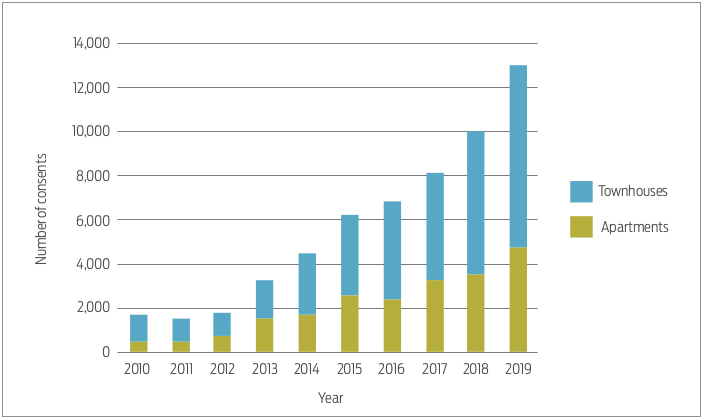

Although COVID-19 may negatively impact the popularity of mid-rise housing in the near future, this form of townhouses and apartments has been growing in popularity, accounting for over 40% of new residential consents last year.

Mid-rise housing has almost become synonymous with medium-density housing as the push for densification of our cities continues. This is aided by the lack of information around the growing trends of midrise housing. Storey information is lacking at best and unavailable in many cases.

Statistics New Zealand does not collect information on the number of storeys, instead opting to group dwellings solely by dwelling type. This can lead to a blind spot around housing trends, particularly around the apartment and townhouse markets. The types of dwellings used by Stats NZ are:

- houses

- apartments

- retirement village units

- townhouses, flats, units and other dwellings.

For the purpose of this article, we use apartments and townhouses to represent mid-rise housing. When we refer to multi-unit housing, this includes retirement village units.

Strong growth in mid-rise/densified housing

Overall, there has been an exponential growth of consents for mid-rise housing over the last 10 years. The rise of townhouses over the last 5 years and the strong year-on-year growth in 2018/19 showed a change in what was being delivered by the new house industry in New Zealand. Last year saw new multi-unit consents account for just over 40% of all new residential consents, compared to just 16% 10 years ago.

Where we are building?

Territorial authorities (TAs) for New Zealand’s larger cities tend to have a higher proportion of multi-unit dwellings than average.

The highest proportions of multi-unit dwellings last year were Wellington City (77%), Hamilton City (67%), Lower Hutt City, Queenstown-Lakes District and Auckland (all 55%). These TAs are similar in being main centres and having high land and house prices and limited space for new development.

Future more uncertain

COVID-19 has thrown development up in the air. We know from previous downturns that apartments and townhouses tend to be hardest hit. Banks may require a larger proportion of presales before development can start and demand for all types of housing may decrease, affecting the apartment and townhouse market to a larger extent than stand-alone housing.

The extent to which the downturn affects consents depends on housing demand, migration trends, housing preferences, and affordability.

First published August 2020 in build magazine, issue 179.

Date posted: 16 September 2020